Crafting The Better B2B ‘Customer’ Experience

PYMNTS

OCTOBER 6, 2020

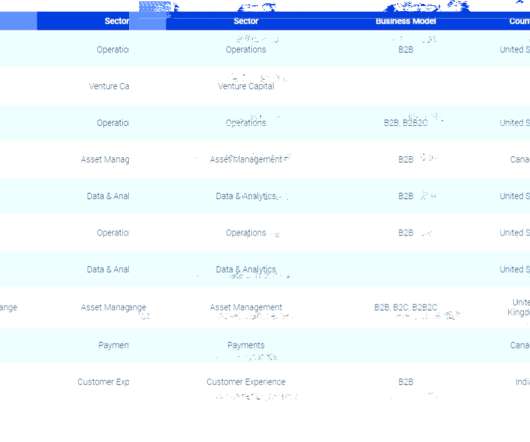

That’s been spurred in part by the fact that supply chain-focused technology is getting faster, cheaper and easier to scale within companies. Improving the B2B Customer Experience. The B2B customer experience, noted several panelists, now includes payments. Fostering Cultural Change.

Let's personalize your content