3 Ways Financial Institutions Can Step Up for Underserved Communities

Perficient

AUGUST 9, 2022

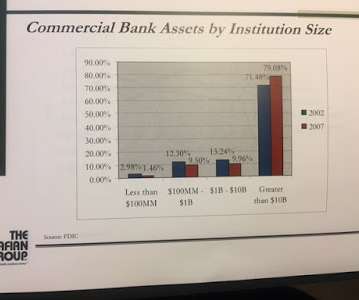

The financial services industry must consider its customer experience game while also grappling with a sense of distrust from many communities due to systematic barriers, maintaining utmost accessibility due to the essentiality of the business, and the lack of financial literacy across the country. Trust and Transparency. .

Let's personalize your content