FinTech N26 Mulls New Funding Round

PYMNTS

OCTOBER 12, 2020

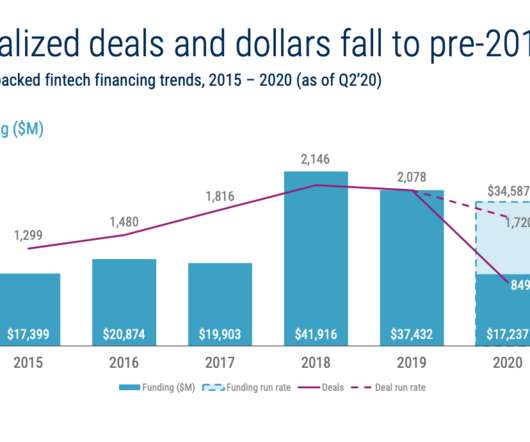

billion, Berlin-based FinTech N26 is exploring seeking additional investments in calendar 2021, Bloomberg reported Monday (Oct. N26 already has raised nearly $800 million in venture capital, Bloomberg reported, including a $100 million round in May 2020. Venture capital investment in Europe’s FinTech industry has surpassed $35.4

Let's personalize your content