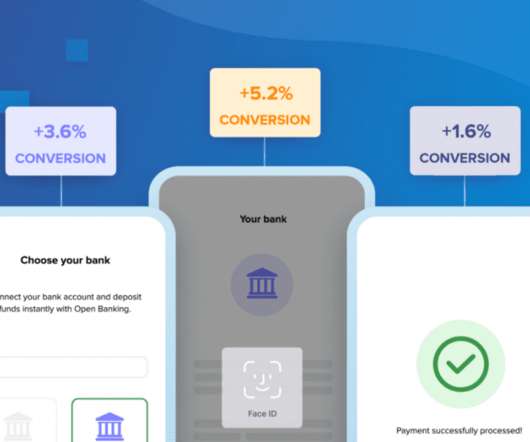

Open Banking Meets Instant Payments At The Online Checkout

PYMNTS

JANUARY 25, 2021

And those three years have given rise to a slew of new companies capitalizing on that initiative all over the world, as well as established companies making their mark. It is definitely getting very cluttered. I mean, how does a piece of plastic have anything to do with online?

Let's personalize your content