Goldman Gets Green Light To Operate Bank In South Africa

PYMNTS

JANUARY 20, 2020

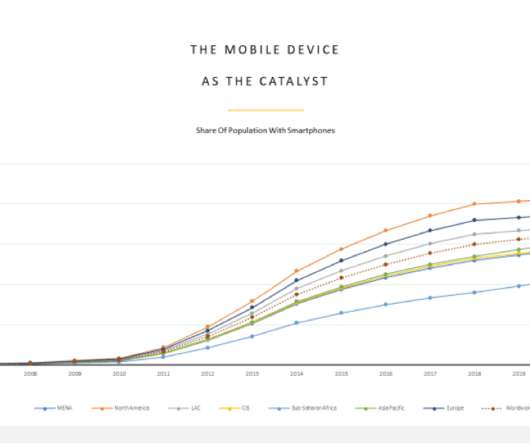

South African regulators also approved Goldman Sachs for a bank operation license as the firm strives for growth in the most liquid and sophisticated economy on the continent. Africa’s eCommerce volume is expected to reach $75 billion by 2025, and economic output in FinTech is anticipated to add $150 billion by 2022 to its GDP.

Let's personalize your content