GEICO, State Farm, Nationwide, Progressive, USAA Top Q1 2022 Mobile Insurance Scorecard

Perficient

APRIL 4, 2022

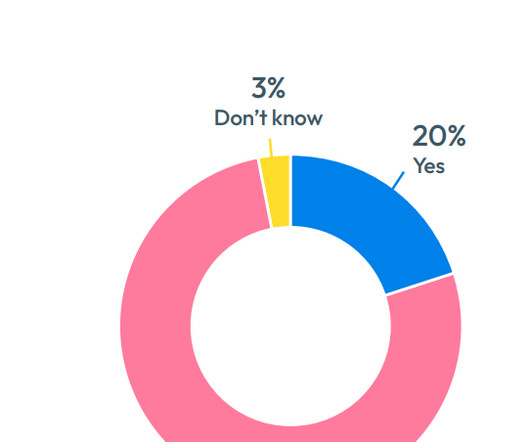

Recently, Digital Insurance issued the findings from Keynova Group on the 2022 Mobile Insurance Scorecard. While mobile has long been a part of the carrier offering – pay a bill, get an ID card, file a claim – this survey reflects the evolution of insurers from transactional into personalized servicing.

Let's personalize your content