How Basel III Affected SMB Lending

PYMNTS

JUNE 10, 2019

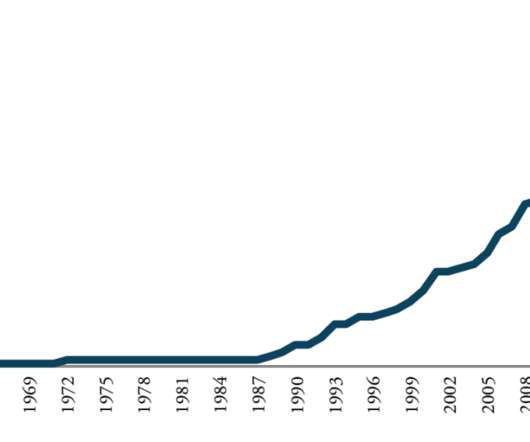

The Financial Stability Board says Basel III rules have not led to a squeeze of the small business bank lending market, according to reports on Friday (June 7). The FSB announced Friday the findings of its analysis of Basel III regulations on the small business lending space. Some regulators aimed to mitigate that impact.

Let's personalize your content