U.S. Regulations to Consider When Managing a Cryptocurrency Fund

Perficient

MAY 27, 2022

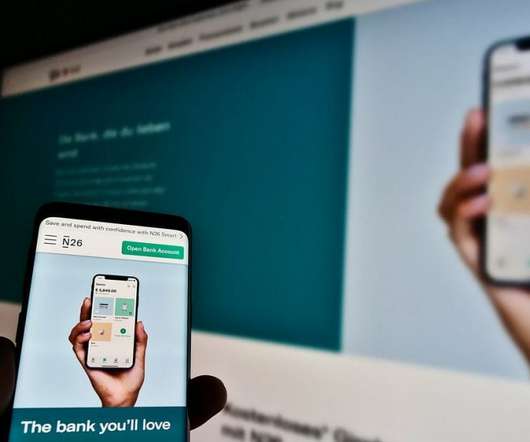

However, in this blog, we will discuss the regulatory landscape surrounding cryptocurrency from an asset manager or fund manager perspective. New York’s BitLicense requirement therefore applies to investment managers who issue digital coins or otherwise act as an exchange platform regardless of where the buyers are located.

Let's personalize your content