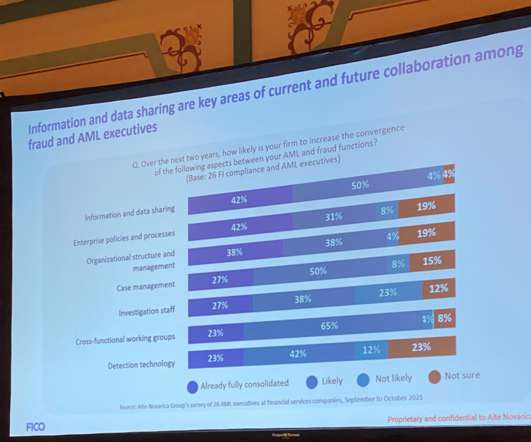

Treasury report examines gaps in banks' AI risk management

American Banker

MARCH 27, 2024

The report seeks to help banks "disrupt rapidly evolving AI-driven fraud," according to Treasury's Nellie Liang. The report found banks have difficulties accounting for AI risks.

Let's personalize your content