How Alternative Lending Technology Stays Flexible For SMBs

PYMNTS

NOVEMBER 16, 2020

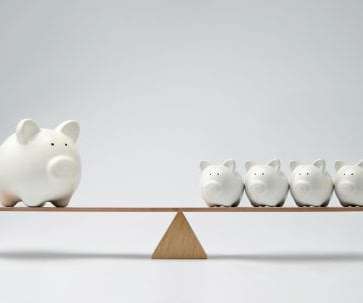

Over the years, that surge in competition gave way to a more collaborative spirit between traditional financial institutions (FIs) and FinTechs as both sides worked to digitize and modernize SMB financing. Flexible Technology. What's just as important is to ensure that lending technology is flexible.

Let's personalize your content