From cybersecurity to failed mergers, 5 challenges facing banks and credit unions

American Banker

MARCH 11, 2024

Bank of America, Citi and Navy Federal are among banks and credit unions to recently manage through unforeseen challenges.

American Banker

MARCH 11, 2024

Bank of America, Citi and Navy Federal are among banks and credit unions to recently manage through unforeseen challenges.

The Financial Brand

MARCH 12, 2024

This article Winning the War for Deposits: Strategies to Drive Real Growth appeared first on The Financial Brand. Q&A: Kasasa's Ryan Walker on using rewards checking to attract low-cost core deposits and boost engagement without relying on rate shoppers. This article Winning the War for Deposits: Strategies to Drive Real Growth appeared first on The Financial Brand.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

MARCH 14, 2024

Strengthening customer relationships with tangible value and personal touch Customer retention in banking can be challenging for community financial institutions. Follow this guide for strategies to stay competitive. You might also like this SMB Lending Insights report for banks and credit unions Download report Takeaway 1 Banks need to implement customer retention strategies to keep their valuable customers, not just attract new ones.

ATM Marketplace

MARCH 12, 2024

First Internet Bank CEO David Becker believes that banks should take a "forward looking approach" with AI, especially in the area of data processing.

Advertisement

Discover the key benefits of portfolio loans and learn how to streamline your lending process with our infographic, "5 Things Lenders Need to Know About Portfolio Loans & Their Documentation." Find out how portfolio loans can maximize borrower potential by consolidating multiple properties under a single loan, reducing paperwork, and lowering closing costs.

Payments Dive

MARCH 14, 2024

Consumer Reports Senior Director Delicia Hand said preventing fraud and scams is "crucial" for traditional and digital banks alike, as more of their customers use their mobile apps.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

The Financial Brand

MARCH 11, 2024

This article Why Credit Unions Are Primed to Revolutionize Financial Services in the U.S. appeared first on The Financial Brand. Younger consumers are ready to become credit union customers, if the industry leans into its strengths, powered by digital technology. This article Why Credit Unions Are Primed to Revolutionize Financial Services in the U.S. appeared first on The Financial Brand.

South State Correspondent

MARCH 12, 2024

In a previous article ( HERE ), we discussed several factors that drive loan and bank profitability. We covered in detail how and why community banks can increase loan size to improve return on assets (ROA) /return on equity (ROE). In this article, we will consider how and why loan term is a significant driver of profitability for community banks and what community banks can do to improve performance.

South State Correspondent

MARCH 14, 2024

When it comes to bank planning, your strategic horizon has a huge influence on your success. Recently, we published a piece urging banks to set their strategic planning horizon out longer ( HERE ). We were inundated with questions and opinions. Our overarching point was that banks underperform, in part, because their strategic planning time horizon is too short.

Abrigo

MARCH 13, 2024

How to respond to CRE loan distress Use these tips for banks and credit unions to identify and handle commercial real estate loans that are showing signs of being problem CRE credits. Would you like other articles like this in your inbox? Takeaway 1 Engaging the bank or credit union loan workout team or an outside expert can help restore CRE loans in distress or mitigate their impact.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant or getting "ghosted" if they fail to meet the evolving needs of Gen Z consumers. In this new webinar, Brian Muse-McKenney of Episode Six and Matt Simester of Payments Consultancy Limited will reveal key considerations banks should factor into their efforts to develop target products for the next generation of bank customers.

Payments Dive

MARCH 11, 2024

“We are all in an arms race to protect this ecosystem, to protect the network,” Visa CEO Ryan McInerney said at an investor conference last week.

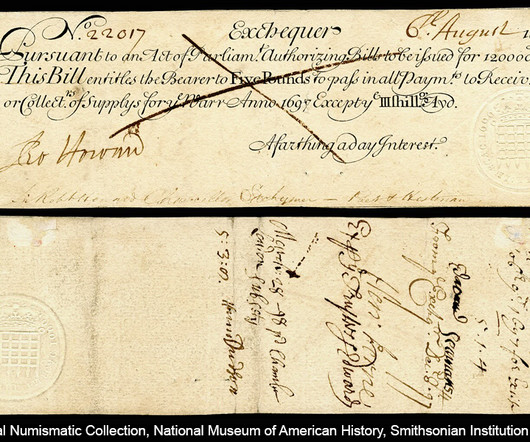

BankUnderground

MARCH 12, 2024

David Rule and Iain de Weymarn Technologies such as distributed ledgers create the possibility of new forms of digital money, whether privately-issued ‘stable coins’, tokenised commercial bank deposits, or central bank digital currencies. Authorities are considering a world where digital money circulates alongside existing forms of money. In the past, the nature of money has often changed.

ATM Marketplace

MARCH 12, 2024

First Internet Bank CEO David Becker believes that banks should take a "forward looking approach" with AI, especially in the area of data processing.

TheGuardian

MARCH 9, 2024

The PM’s admiration for Washington’s economic model may backfire amid looming US banking and stock market disasters One of the consistent themes of the Conservative economic narrative is an admiration for the US and its ability to grow quickly. The way it has bounced back from the pandemic and how it has ridden out the impact of Russia’s invasion of Ukraine should serve as a blueprint.

Speaker: Gary Dmitriev

Our upcoming webinar aims to demystify the process of selecting and implementing automation tools for financial institutes. This session will provide your roadmap for vetting potential solutions, focusing on due diligence, vendor assessments, and aligning technology with strategic goals. We’ll also address the critical issue of innovation fatigue, offering tips on maintaining enthusiasm and momentum for new initiatives.

Payments Dive

MARCH 15, 2024

“We know dangers exist when more powerful players weaponize industry standards,” Consumer Financial Protection Bureau Director Rohit Chopra said in advance of finalizing an open banking rule later this year.

William Mills

MARCH 12, 2024

In a time where information reigns supreme, the strategic use of proprietary data in PR and marketing is not just an advantage — it's essential. As data-driven storytelling has become a cornerstone for success, PR and marketing professionals must learn how to properly gather, analyze and derive this information to help create stronger messages, bring more credibility, and garner greater media attention for clients.

CFPB Monitor

MARCH 15, 2024

The Consumer Financial Protection Bureau (“CFPB”) filed an opposition brief (the “Opposition”) on Tuesday in response to a request by plaintiff trade groups to enjoin the CFPB’s final credit card late fee rule (the “Final Rule”) during the pendency of a lawsuit seeking to invalidate the Final Rule. In the Opposition, the CFPB argues that plaintiffs are unlikely to succeed on the merits, and that the Final Rule is consistent with the CARD Act’s mandate that late fees be “reasonable and proportion

BankBazaar

MARCH 15, 2024

Ever wondered why you splurge on things you don’t need or why your impulse buys or saving strategies are shap ed the way they are? Dive into the world of psychology of money with us to find out more! In the labyrinth of personal finance, our decisions are often guided not just by numbers and logic, but by other factors, like tradition, information available to us and the avenues of risk we are willing to take.

Advertisement

Shifting liability for digital fraud losses represents a significant challenge for financial institutions and payment service providers. In response to the global surge in digital fraud, regulators are introducing policies that transfer the cost of fraud from defrauded customers to financial institutions. ThreatMark’s newly released white paper, "The Liability Shift: Understanding Fraud Losses Responsibility and Mitigation," provides an in-depth analysis of this shift, its implications, and stra

Payments Dive

MARCH 11, 2024

The bank’s payments unit plans to engage in more pilots this year before rolling out the checkout service broadly next year, said Prashant Sharma, JPMorgan’s executive director of biometrics and identity solutions.

William Mills

MARCH 14, 2024

We all cherish those networkers with a superpower for connecting people. Now there’s a conference that’s honed in on meeting the need: Fintech Meetup. Here’s our take on the show.

CFPB Monitor

MARCH 14, 2024

On January 17, 2024, the U.S. Supreme Court heard oral argument in two cases in which the question presented is whether the Court should overrule its 1984 decision in Chevron, U.S.A., Inc. v. Nat. Res. Def. Council, Inc. That decision produced what became known as the “ Chevron judicial deference framework”–the two-step analysis that courts typically invoke when reviewing a federal agency’s interpretation of a statute. .

BankBazaar

MARCH 14, 2024

The end of the financial year is the perfect time to review your financial situation and make strategic moves to optimise your money matters. Here are essential finance moves to consider. As a young professional in India, managing your personal finances effectively is crucial for securing your financial future. With the end of the financial year fast approaching, now is the perfect time to review your financial situation and make strategic moves to optimise your money matters.

Advertisement

Discover First Mid Bank's Expansion Success with Our Case Study! Discover how First Mid Bank & Trust fast-tracked market expansion through advanced automation and compliance solutions. This case study reveals their journey from facing challenges in Texas' complex legal landscape to achieving rapid market entry with GoDocs' innovative commercial closing platform.

Payments Dive

MARCH 13, 2024

The BNPL provider’s CEO has suggested the company could IPO “quite soon,” but fintech investors expect the market will first want to see a stronger track record of profitability.

American Banker

MARCH 15, 2024

As nonbank entities expand their market share in many traditional banking services and are increasingly intertwined in the banking system, regulators' approach to leveling the playing field has been incremental and situational.

CFPB Monitor

MARCH 13, 2024

As previously reported , bills were introduced in the U.S. House of Representatives (H.R. 7297) and U.S. Senate (S. 3502) to amend the Fair Credit Reporting Act (FCRA) to curtail the practice of trigger leads with mortgage loans. Recently, a diverse group sent a letter to the Chairs and Ranking Members of the House Committee on Financial Services and the Senate Committee on Banking, Housing & Urban Affairs expressing support for the bills.

ATM Marketplace

MARCH 15, 2024

How can operators delay or frustrate ATM attacks long enough to be effective?

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

Let's personalize your content