Consumers Embrace Debit Amid Ongoing Uncertainty

PYMNTS

OCTOBER 14, 2020

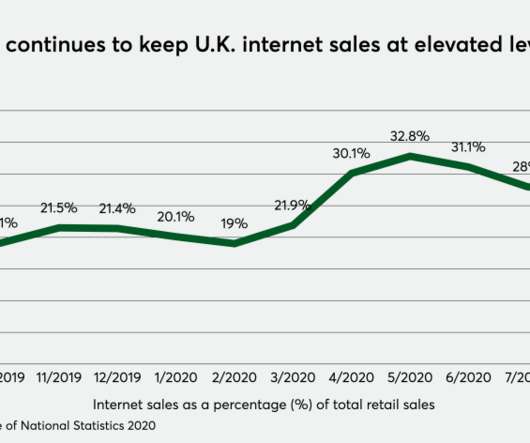

When the chips are down, consumers love and trust their debit cards. Among clear COVID-era trends is the embrace of debit for managing and mastering new realities. “Debit cards remain the payment method of choice among U.S. consumers, regardless of whether they are shopping online or in stores, according to recent reports,” notes PYMNTS October Next-Gen Debit Tracker® done in collaboration with PULSE , A Discover Company.

Let's personalize your content