Deep Dive: Safeguarding B2B eCommerce And The Corporate Customer Experience

PYMNTS

FEBRUARY 21, 2020

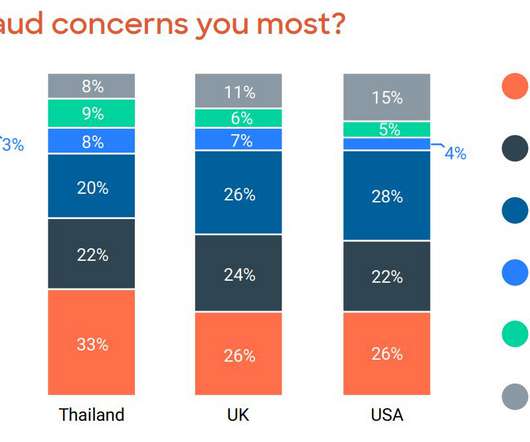

Vendors looking to appeal to these corporate buyers’ shopping preferences and expectations must therefore ready online sales channels like merchant websites and B2B marketplaces. trillion by 2020, but new sales channels also invite emerging fraud forms. The Sizable Online Fraud Threat. Detecting Fraudsters.

Let's personalize your content