Banks Should Make 2024 a True ‘Year of Digital’

Gonzobanker

MARCH 28, 2024

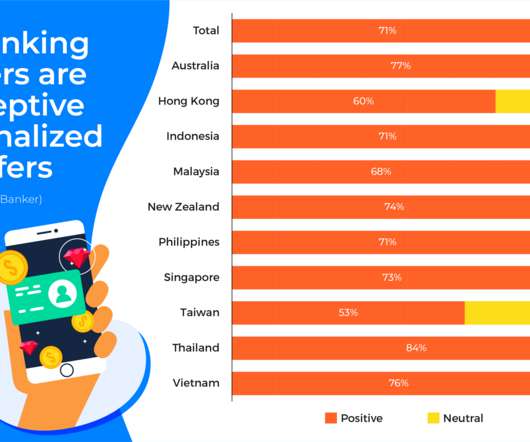

The digital players are working to differentiate based on stronger customer experience features and tight integrations in areas such as financial health, data-driven marketing and fraud/security. Bank and credit union leaders must love their due diligence! Bank and credit union leaders must love their due diligence!

Let's personalize your content