DevSecOps Best Practices ? Automated Compliance

Perficient

JUNE 5, 2020

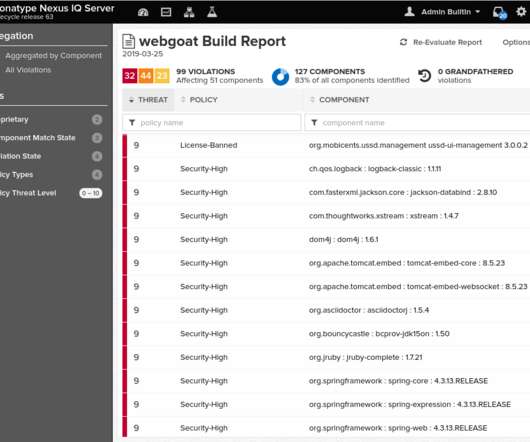

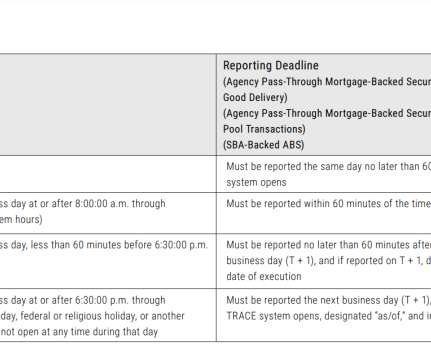

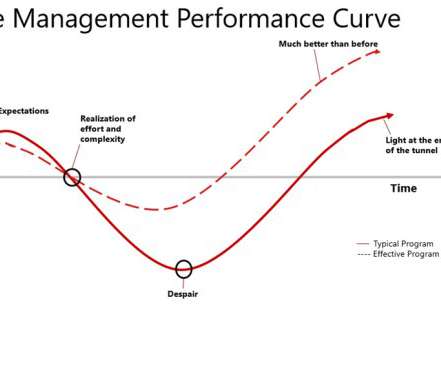

As a best-practice it is recommended to adopt automation of certain security audits, integration of compliance oversight into key development process areas (e.g. For example, if a developer creates a user interface element (i.e. Operational Security. Secrets are necessary for the operation of all modern software systems.

Let's personalize your content