Treasurers Trust Big Data For Real-Time Risk Assessment

PYMNTS

JUNE 20, 2017

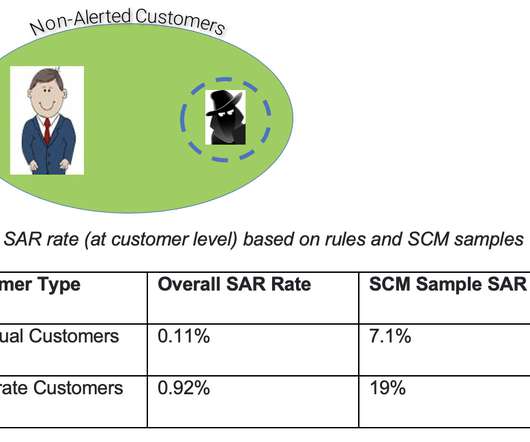

But Big Data lands new capabilities in the hands of corporate treasurers and other executives that yields active, real-time assessments of risks from multiple angles, from counterparties to compliance. There are several ways heightened data management can yield more effective risk mitigation , Hazeltree noted.

Let's personalize your content