Focus: New-To-Credit Millennials, Credit-Rating Systems & Borrowing Credit

BankBazaar

AUGUST 7, 2019

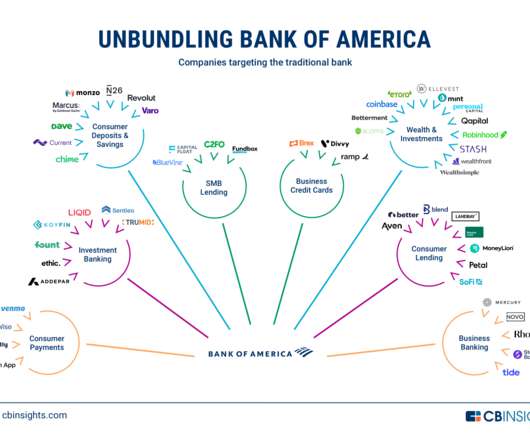

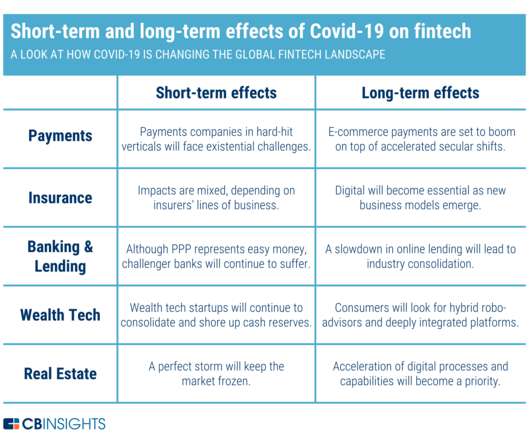

Owing much to the changes in banking trends and the emergence of fintech companies, millennials across India have become open to the idea of borrowing credit. Access to credit products such as Credit Cards and loans may be rather easy today, but it wasn’t the case till a few years ago. Check out these amazing offers on Credit Cards!

Let's personalize your content