How resilient are UK corporate bond issuers to refinancing risks?

BankUnderground

MARCH 6, 2024

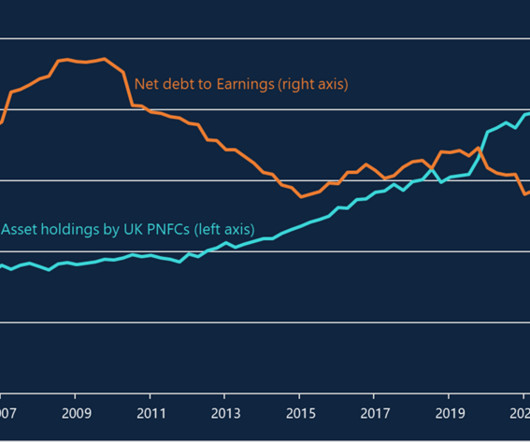

Tighter financing conditions may make it harder for some businesses to refinance their debt or could mean they face less favourable terms when they do. This blog explores the extent to which bond maturities could crystallise these refinancing risks. How large are bond refinancing risks in aggregate?

Let's personalize your content