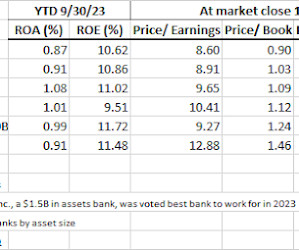

The Top 20 Deposit-Rich Industries for 2023

South State Correspondent

MARCH 30, 2023

While desiring to bank everyone in your community is noble, it can be a poor use of resources. Not to say you want to ignore parts of your community, but why not focus more of your resources on those industries that will make your bank more profitable? While there are approximately 4,400 independent security firms in the U.S.,

Let's personalize your content