Klarna creates global ‘Consumer Council’

Bank Innovation

FEBRUARY 13, 2020

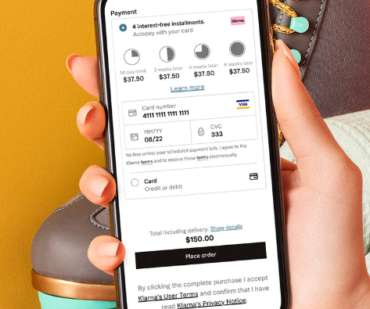

Point-of-sale lender Klarna, which has a banking license in Europe and partners with banks in other markets, is creating a new mechanism to acquire feedback as it evolves its products. The “Consumer Council” will take the form of in-person meetups three times a year in each market.

Let's personalize your content