Today’s Cyber Risk Management

Cisco

JUNE 7, 2022

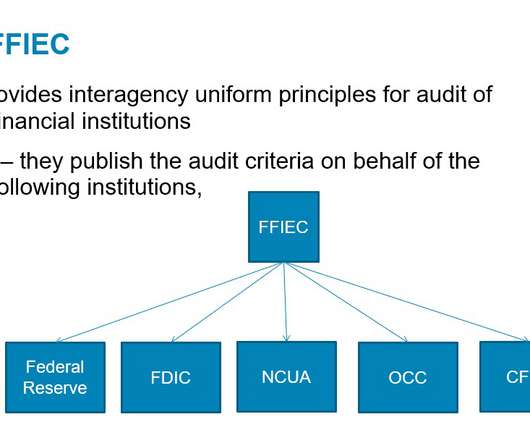

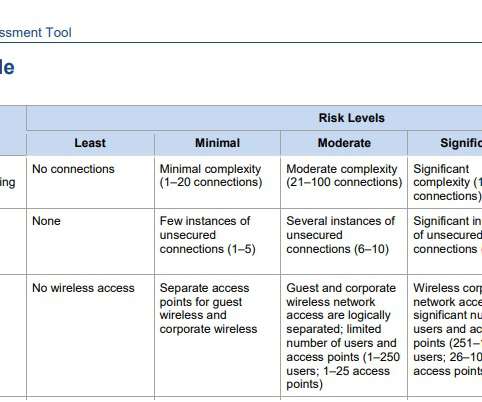

The past 20 years have visibly demonstrated the impact large scale events have on market, credit, and operational risks in financial services. This quickly metastasized into significant global credit risk for large institutions and became the biggest existential threat to the industry in more than a century.

Let's personalize your content