How Alternative Lending Technology Stays Flexible For SMBs

PYMNTS

NOVEMBER 16, 2020

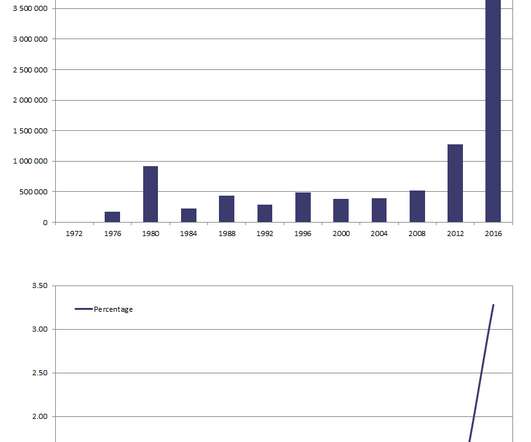

In the wake of the 2008 global financial crisis, and banks' subsequent pullback from the small- to medium-sized business ( SMB ) lending arena, a slew of alternative lenders emerged onto the scene to fill the credit gap. It is now not only a competitive advantage, but an essential requirement for lenders to operate digitally, said Marceau.

Let's personalize your content