FDIC draws bright line between insured and uninsured

American Banker

DECEMBER 21, 2023

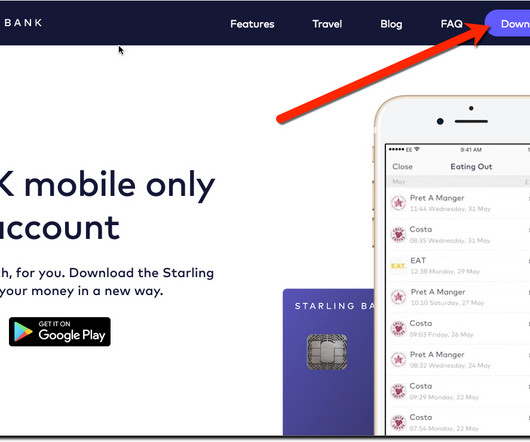

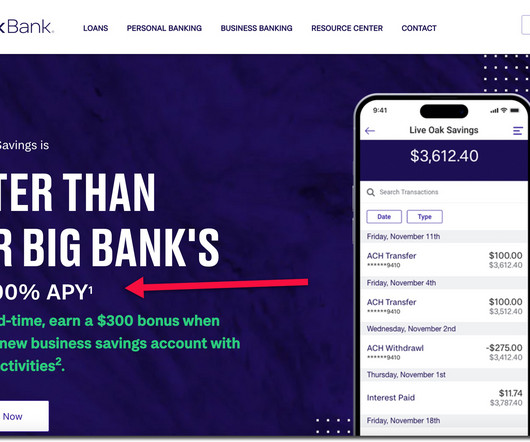

finalized rules governing display of the FDIC logo Wednesday, requiring a new digital FDIC sign on online banking platforms beginning in 2025, conspicuous physical signs in nontraditional bank facilities and explicit labeling of insured and non-deposit products. The Federal Deposit Insurance Corp.

Let's personalize your content