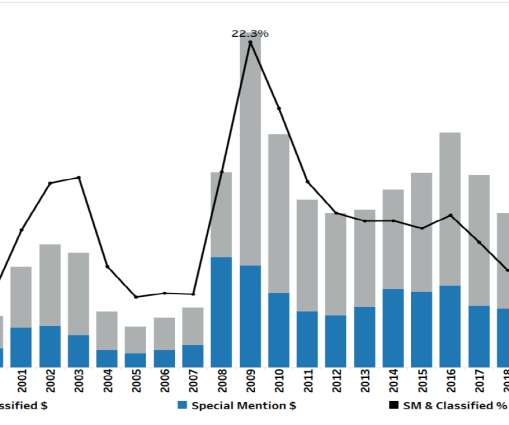

FDIC reports bumpy 4Q for banks, warns of credit risks ahead

American Banker

MARCH 7, 2024

Net income at the nation's more than 4,000 banks dipped markedly in the final quarter of 2023, though for the full year it exceeded pre-pandemic averages. Deterioration in commercial real estate and credit card lending is a concern, FDIC Chairman Martin Gruenberg says.

Let's personalize your content