FDIC RESPA Section 8 Settlement Acknowledges Legitimacy of Marketing Arrangements

CFPB Monitor

NOVEMBER 7, 2019

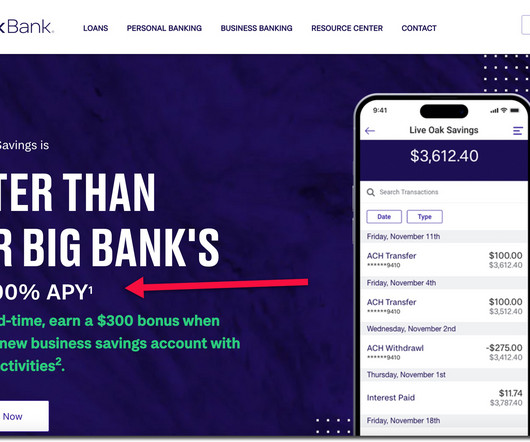

This is significant, as a federal banking regulator is confirming that both co-marketing and desk rental arrangements are permissible if the fees paid bear a reasonable relationship to the fair market value of marketing or rental costs.

Let's personalize your content