Contactless Payment: The future of public transportation

Payments Dive

JANUARY 8, 2021

When it comes to moving forward, what type of payment structure can customers count on from public transportation?

Payments Dive

JANUARY 8, 2021

When it comes to moving forward, what type of payment structure can customers count on from public transportation?

PYMNTS

JANUARY 8, 2021

Robinhood is considering selling shares directly to its users if it opts to hold an initial public offering (IPO). The FinTech group is reportedly mulling setting aside a significant number of shares for users if it goes public, but it has yet to make any final decisions, according to Bloomberg, who cited unnamed sources. Bloomberg notes that such an offering would be unusual, as retail investors generally do not get an opportunity to participate in an IPO at the offering price.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accenture

JANUARY 8, 2021

Central bank digital currency (CBDC) represents a potential digital sea change in the daily function of finance. The key innovation is the adoption of a value-based, or token-based, approach to money.

PYMNTS

JANUARY 8, 2021

Whether it was helping small businesses get their PPP payments or convert to eCommerce, getting cash in the hands of workers delivering food, or accommodating digitized mortgage closing and escrow activity, the coronavirus has foisted a lot of change on the financial services industry in a short amount of time. “A lot of what the pandemic did was force our industry to truly be digital, to facilitate frictionless transactions,” TCH Senior Vice President Elena Whisler said in a recent conversation

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Source

JANUARY 8, 2021

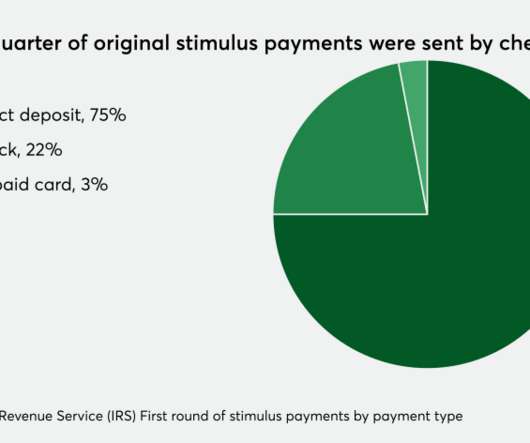

The Treasury Department and IRS are sending out approximately 8 million Visa prepaid cards to deliver a second round of Economic Impact Payments (EIPs) to consumers.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Source

JANUARY 8, 2021

The COVID-19 pandemic of 2020 saw some businesses become big winners — such as Zoom, Home Depot and payments companies like PayPal — while other businesses suffered heavily, most notably the travel and hospitality industries. Credit card issuers also suffered, as demand lagged heavily for new cards and their overall spending dropped considerably during the year.

PYMNTS

JANUARY 8, 2021

Equifax has inked a deal to purchase artificial intelligence (AI)-powered fraud prevention and digital identity technology provider Kount for $640 million. Kount’s staff members will become a part of Equifax’s United States Information Solutions (USIS) business unit and will still be based in Boise, Idaho, according to a Friday (Jan. 8) announcement.

Jack Henry

JANUARY 8, 2021

As we look back upon 2020 it’s easy to feel as though we’ve stepped into an alternate universe. Who might have guessed, heading into the year that a health crisis would emerge and reverberate through the economic and social fabric of our world? And, while we’ll be forever changed by the experiences of this year, we must also look toward the future, and the promise of recovery the new year brings.

PYMNTS

JANUARY 8, 2021

Even though he thinks waves of the coronavirus will be around for at least another year or two, LeanTaaS CEO Mohan Giridharadas said that at least one side effect of the pandemic could affect the healthcare system forever. “I think what COVID has done is put a bright spotlight on how hard it is to manage [healthcare] capacity and how easily a system that is operating on the edge of capacity can get overwhelmed,” Giridharadas said in a recent conversation with PYMNTS.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

ATM Marketplace

JANUARY 8, 2021

Consumers want self-service, but they also want to speak to an employee when necessary, according to the keynote presentation during the recent Self-Service Innovation Summit. The degree to which a customer wants an employee involved varies significantly among industries.

PYMNTS

JANUARY 8, 2021

Amazon has ended one of its first efforts to sell food online, with the eCommerce retailer closing its Prime Pantry service. Many items available under the Prime Pantry name in the past were integrated into its main website, Bloomberg reported. “As part of our commitment to delivering the best possible customer experience, we have decided to transfer [the] Amazon Pantry selection to the main Amazon.com store so customers can get everyday household products faster, without an extra subscription o

Payments Source

JANUARY 8, 2021

The credit reporting firm has been building out its identity and fraud protection business for existing customers, which include many of the world’s largest banks and telecommunications companies.

PYMNTS

JANUARY 8, 2021

At a time of huge digital transformation when consumers have quicker access to more products and services than ever, why be clunky if you can be seamless? So goes the thinking of Jason Hogg , the recently hired executive vice president of the Preferred Leasing unit of Rent-A-Center, which is aiming to take the lease-purchase segment of the alternative credit market to the next level along with its recent acquisition of Acima.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

BankInovation

JANUARY 8, 2021

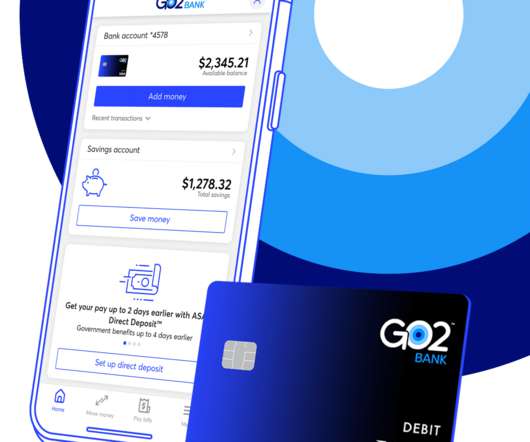

This week, Green Dot unveiled GO2bank, its second digital-only bank, the same week BBVA USA announced it was shuttering its neobank, Simple, according to published reports. Green Dot, which has bolstered its app with existing and new automated features, faces an uphill battle as it enters the crowded challenger bank field. Meanwhile, Chase’s automated savings tool is gaining traction, and total amounts […].

PYMNTS

JANUARY 8, 2021

The year 2020 meant big changes for retailers that had primarily defined themselves by physical interaction as brick-and-mortar merchants were forced to adapt to an eCommerce-focused world as their best option for holding on to their now homebound customer base. That digital dive was difficult for many sellers and gave a stiff advantage in the competition to those who began the race this year already digital-enabled and ready to meet the eCommerce customer’s increasingly exacting experience requ

BankInovation

JANUARY 8, 2021

The irony of automation is that while companies are pushing to automate payments, many are still dealing with paper-based invoices. In 2021, companies will look to change that, predict some industry leaders. “Citizens has had for some time payable automations, in digitalizing how customers pay for things,” said Ray Champ, senior vice president for commercial […].

PYMNTS

JANUARY 8, 2021

Retail rents have plummeted to historic lows in New York City amid the COVID-19 pandemic, as bankruptcies and vacancies penetrated the area, CNBC reported on Friday (Jan. 8). Rent for retail space in New York City took a nosedive amid the pandemic, dropping about 25 percent from the same period in 2019, as longtime retailers like Neiman Marcus and Century 21 shuttered stores.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

ABA Community Banking

JANUARY 8, 2021

CEO Q&A. The post Darrin Williams: Behind the Scenes at an Innovative CDFI appeared first on ABA Banking Journal.

PYMNTS

JANUARY 8, 2021

Bright spots? In 2020? There were not many of them, we’ll admit. But there were incandescent pockets here and there, if you were an investor, and specifically if you invested in special purpose acquisition companies (more commonly known as SPACs). On Wall Street, of course, you need to follow the money to follow what’s in favor. And SPACs, hot in 2020, are, well, still hot.

Payments Source

JANUARY 8, 2021

There's a way to manage the tricky balance between rapid digitization and the people who still need or prefer cash, and for Ram Chary it can be found in a casino.

PYMNTS

JANUARY 8, 2021

There's no doubt that the small business community is facing a period of immense tribulation. In addition to navigating forced shutdowns and supply chain disruptions, business owners are now tasked with making some difficult decisions about how to keep their business alive, or whether to throw in the towel. With so much financial hardship, the traditional avenues for funding that would otherwise be serving as vital lifelines for small and medium-sized businesses (SMBs) are often missing, and fir

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

American Banker

JANUARY 8, 2021

Despite limiting on-site visits and adding more self-service channels, the industry is forging ahead with plans for hundreds of new or expanded brick-and-mortar locations.

PYMNTS

JANUARY 8, 2021

For many businesses, the sudden shift to a work-from-home model created chaos. Organizations large and small were forced to migrate to online and cloud-based solutions to keep operations moving, often with significant friction. As firms start to settle into the new normal, however, business leaders have the opportunity to take a more deliberate and tactful approach to their digital transformation strategies.

American Banker

JANUARY 8, 2021

Absa Group is drawing on global training data from the fintech Kasisto and annotators who review conversations with clients to help in fine-tuning its virtual assistant.

PYMNTS

JANUARY 8, 2021

Today in B2B payments, ActiveWorx launches its B2B payment optimization tool, while PayJunction debuts an eInvoicing feature. Plus, U.K. debt collectors seek a bigger role in recovering SMB aid, Fides expands bank connectivity for treasurers and jobless claims dip slightly. ActiveWorx Introduces B2B Payments Offering on AP Platform. ActiveWorx, Inc.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content