91st Banking Diploma Exam Routine Published

FluentBanking

NOVEMBER 3, 2020

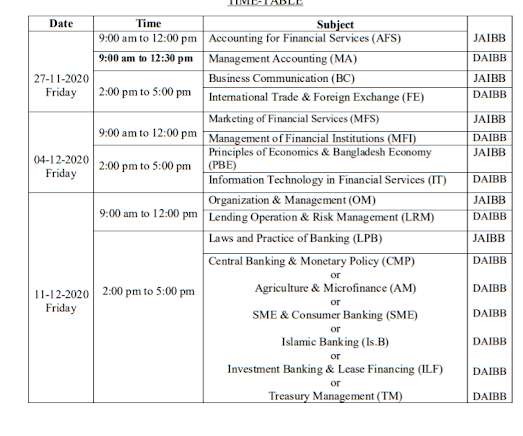

The Institute of Bankers Bangladesh published it's 91st Banking Diploma exam routine. This routine is published by IBB in the midst of the current pandemic situation when almost all the physical exam are postponed by the Govt. However, this exam was previously postponed due to the same situation. A few days ago Bangladesh Bank published a circular, where it instructed all the private, public and foreign banks to keep specific number for JAIBB and DAIBB while considering officers for promotion.

98

98  98

98

Let's personalize your content