Foundation opines on crypto bill

Payments Dive

JUNE 7, 2022

The Electronic Transaction Association and the Stellar Development Foundation provide their take on this week’s bipartisan Senate bill to create a regulatory framework for cryptocurrencies.

Payments Dive

JUNE 7, 2022

The Electronic Transaction Association and the Stellar Development Foundation provide their take on this week’s bipartisan Senate bill to create a regulatory framework for cryptocurrencies.

Accenture

JUNE 7, 2022

While culture has always played an important role in talent retention at banks, it hasn’t always received the focus and investment it deserves. But as the Great Resignation unfolds and record-breaking numbers of Americans continue to leave their jobs, and as the demand for talent (especially digital talent) in banking intensifies, the need to modernize organizational….

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JUNE 7, 2022

Apple Pay Later will let users split the cost of an Apple Pay purchase into four equal payments over a six-week period, with no interest or fees. It will be available via the Mastercard network.

Cisco

JUNE 7, 2022

The past 20 years have visibly demonstrated the impact large scale events have on market, credit, and operational risks in financial services. Beginning with the bursting of the dot-com bubble, and more recently, the global COVID-19 pandemic, these events created significant volatility in stock prices resulting in increased market risk. In between these events, a different crisis began in the US sub-prime lending market.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

JUNE 7, 2022

A shareholder is pushing Square parent Block to give up super voting shares. The proposal will be voted on at Block’s annual meeting next week.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

JUNE 7, 2022

"When it comes to delivering that level of personalization through high-touch digital channels, most banks and credit card providers are missing the mark," J.D. Power said in a new consumer survey report.

BankInovation

JUNE 7, 2022

Paul Margarites knows a thing or two about digital transformation. As head of U.S. commercial digital platforms at TD Bank, a subsidiary of $1.73 trillion TD Group, Margarites is using his past experience — including in the wealth management group at $3.24 trillion Bank of America Merrill Lynch and as an executive director for cloud-based […].

CFPB Monitor

JUNE 7, 2022

For the second time in two weeks, the U.S. Supreme Court has ruled against a company seeking to compel individual arbitration of Fair Labor Standards Act (FLSA) collective action claims. In Southwest Airlines Co. v. Saxon , the Court held that the plaintiff’s claims were exempt from arbitration under Section 1 of the Federal Arbitration Act (FAA), which exempts from the statute’s ambit “contracts of employment of seamen, railroad employees, or any other class of workers engaged in foreign or in

ABA Community Banking

JUNE 7, 2022

To help community banks successfully implement the current expected credit loss accounting standard, the Federal Reserve next week will launch a second tool, the Expected Losses Estimator. The post Fed: Second CECL tool for community banks to launch June 16 appeared first on ABA Banking Journal.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

CFPB Monitor

JUNE 7, 2022

On May 25, 2022, my colleagues, Mike Gordon, John Culhane and Ron Vaske published a blog which reported on a press release issued by the CFPB on the prior day entitled “CFPB Launches New Effort to Promote Competition and Innovation in Consumer Finance.” The blog stated: In its press release, the CFPB states that “[a]fter a review of these programs [the No Action Letter (NAL) and Compliance Assistance Sandbox (CAS) programs], the agency concludes that the initiatives proved to be ineffective and

CB Insights

JUNE 7, 2022

Dalma , a pet insurance provider, has raised $16M in a Series A. The round drew participation from Northzone Ventures, Project A Ventures, and Global Founders Capital, among others. <span data-sheets-value='{"1":2,"2":"<div class="cbi-cta-shortcode-wrapper"><div class="cbi-cta-shortcode-content"></div><div class="cbi-cta-shortcode-forms" ><div class="cta has-desktop"><div class="cta-deskt

BankInovation

JUNE 7, 2022

PayPal Holdings Inc. will let users transfer certain cryptocurrencies to other customers, exchanges and external wallets, a new service that’s part of the company’s effort to boost usage of its app. “This is really about access and utility,” Jose Fernandez da Ponte, senior vice president and general manager for PayPal’s blockchain, crypto and digital currencies […].

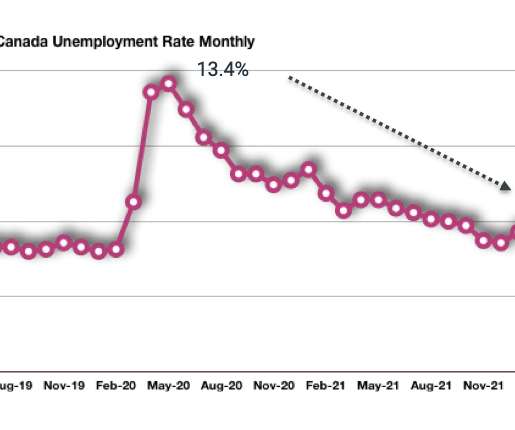

FICO

JUNE 7, 2022

Home. Blog. FICO. Canada Bankcard Industry Benchmarking Trends: 2022 Q1 Update. Canada Sees Low Unemployment, But Rising Inflation – How Will This Affect Bankcard Usage? FICO. Tue, 07/02/2019 - 02:45. by Amir Sikander. expand_less Back To Top. Tue, 06/07/2022 - 15:00. FICO releases quarterly Canada Bankcard Industry Benchmarking trends. Previously, these were published on the FICO Community, but going forward they will be published on the FICO.com blog.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

BankInovation

JUNE 7, 2022

Microsoft plans to expand its Cloud for Financial Services offering beyond the U.S. and Canada to Australia, France, Germany, Ireland, Italy, Mexico, the Netherlands, New Zealand and Switzerland. Beyond geography, the expansion also includes updated language and functionality, Bill Borden, corporate vice president of worldwide financial services at Microsoft, says in today’s episode of “The […].

Bank Activities

JUNE 7, 2022

By Z oran Temelkov June 2022. Chipotle Mexican Grill (NYSE: CMG), the popular American chain of fast-casual restaurants, will accept cryptocurrencies as payments for its products. Chipotle has partnered up with Flexa, a pure-digital payments platform, to enable its customers to pay with 98 cryptocurrencies supported on the platform, including the popular Bitcoin, Ether, Solana, and stablecoins pegged to the U.S. dollar.

BankInovation

JUNE 7, 2022

Fifth Third Bank will migrate its mobile app to the cloud before the end of the year. The $211 billion Cincinnati-based bank initiated its overall cloud migration in 2018 and began a transition to FIS Modern Banking Platform — a cloud-native core banking solution — in July 2021. Fifth Third also offers real-time, cloud-based payments […].

The Paypers

JUNE 7, 2022

Germany-based financial system that combines various payment capabilities in one integrated platform, Payhawk , has announced the second iteration of its Enterprise Suite.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

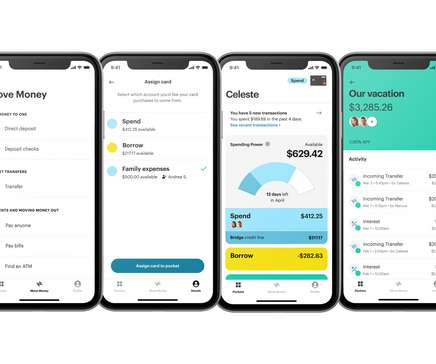

The Paypers

JUNE 7, 2022

Marqeta , a card issuing platform, has teamed up with Western Union to integrate its solution into Western Union’s real-time multi-currency digital wallet and digital banking platform in Europe.

The Paypers

JUNE 7, 2022

TrueLayer , a UK-based Open Banking platform, has announced its collaboration with CMC Markets , an online financial trading business.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

JUNE 7, 2022

Germany-based digital payments processing company epay of financial technology and payments provider Euronet Worldwide has announced additional product launches for its recurring payments solution Renewal.

The Paypers

JUNE 7, 2022

UK-based acquirer Trust Payments has partnered with RiskOps platform Feedzai for a cloud-based risk management platform supported by AI and ML.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content