Fewer taxpayers plan to pay the IRS by check

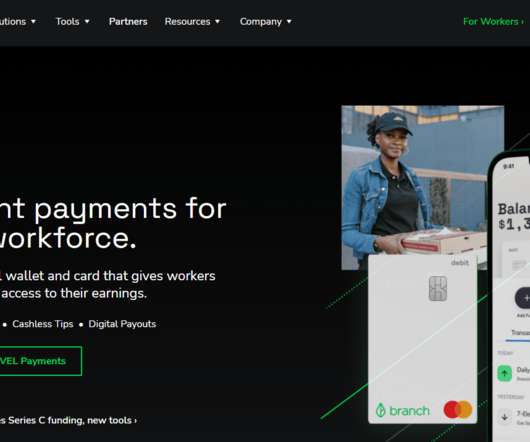

Payments Dive

MARCH 17, 2022

The share of consumers planning to use mobile phones to pay their taxes increased over last year, while the portion preferring to pay by check declined, according to a survey from payments firm ACI Worldwide.

Let's personalize your content