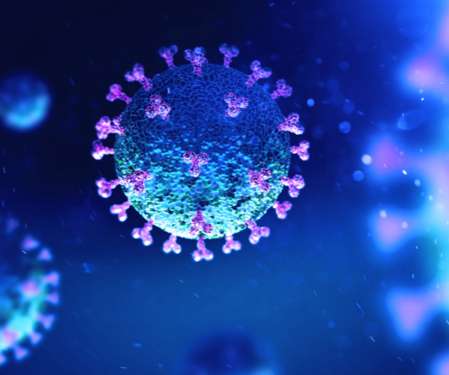

Coronavirus outbreak raises questions about digital payments and cash

Payments Dive

MARCH 13, 2020

The coronavirus pandemic has raised a number of concerns about whether consumers would shift towards digital payments amid concerns about cash handling and interacting with large crowds in banks and retail centers.

Let's personalize your content