Winds of change: How climate risk is shifting regulatory roles

Accenture

JUNE 2, 2021

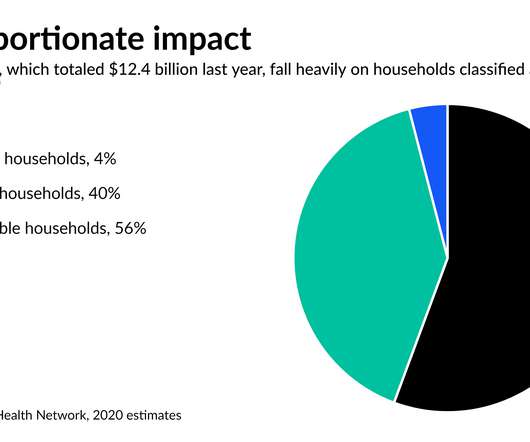

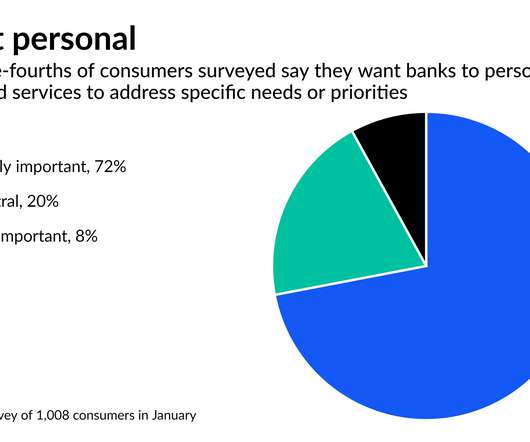

Executive Summary Central banks and regulators around the world know climate risk constitutes a growing risk to financial stability. In their role to enable, manage and supervise financial sector (FS) participants in dealing with environmental risks, a number of them have focused on several crucial areas. Many, however, have been less proactive. They should consider….

Let's personalize your content