Now is the Time to Diversify Revenue Generation

Jack Henry

AUGUST 24, 2021

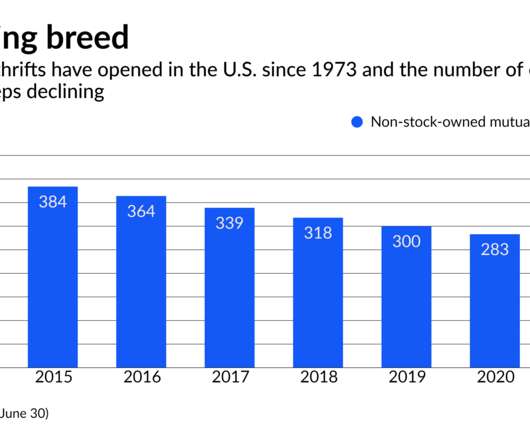

As many of you are aware, there is a proposal in Congress to cap debit interchange, and it’s likely to pass into law. For institutions with less than $10B in assets, the cap could eliminate 25% to 35% of interchange income. While it’s always a good idea to have multiple healthy income streams, this unfavorable outlook for interchange makes it especially relevant now.

Let's personalize your content