Dimensions of disruption in payments

Accenture

DECEMBER 2, 2020

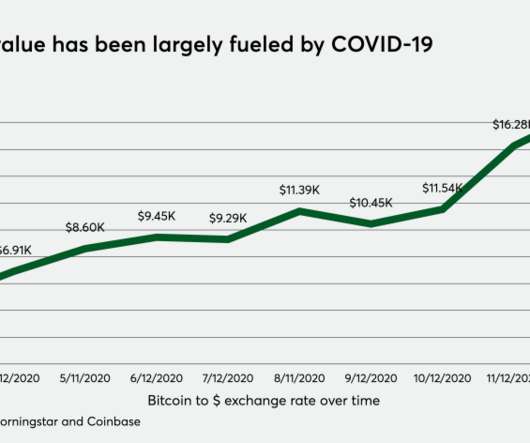

In the first post in this series, we looked at the major trends driving disruption in payments today. This time, we’ll look at how these trends will actually impact the industry by geography and by payments instrument. The findings presented here all come from the new Accenture Payments Disruptability Index, which was created through analysis…. The post Dimensions of disruption in payments appeared first on Accenture Banking Blog.

Let's personalize your content