How Facebook Became Fast Friends with Digital Banks

Bank Innovation

MARCH 13, 2018

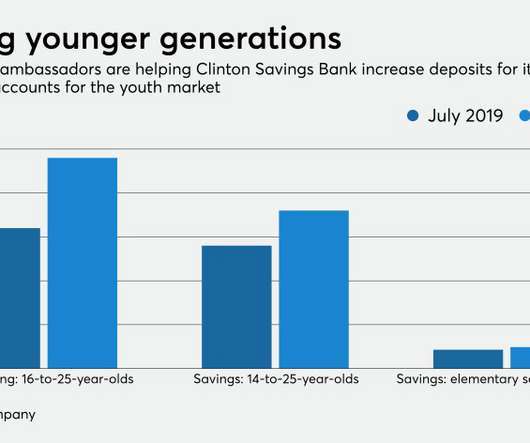

EXCLUSIVE - Before social media platform Facebook became a popular channel for digital banks to offer banking features to its customers, let’s not forget that FB was first and foremost an important advertising tool for banks to reach a younger audience.

Let's personalize your content