Model Risk Management: Regulatory Priorities and Best Practices

Abrigo

MAY 20, 2022

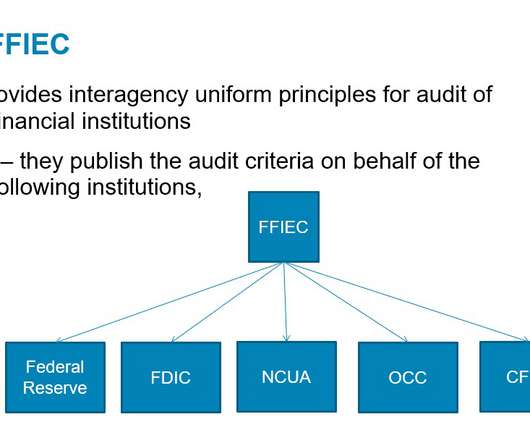

Meet Model Risk Management Expectations Updates to the FDIC Risk Management Manual should steer institutions toward a model that manages risk and drives growth. Takeaway 1 Aside from meeting examiner expectations, proper model risk management can protect your institution from unnecessary risk. .

Let's personalize your content