Data – The Lifeblood of Intelligence Automation

Perficient

SEPTEMBER 21, 2023

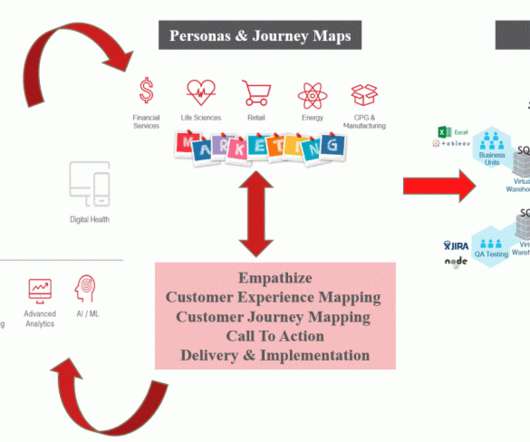

It’s not new news and it doesn’t need to be complicated; it’s just a revolution of how we leverage data! Let’s take a quick dive into the data-driven universe of AI (i.e., This article breaks down how data powers intelligence automation. intelligence automation).

Let's personalize your content