What is TRACE Reporting? (Part 1 of 6)

Perficient

APRIL 14, 2022

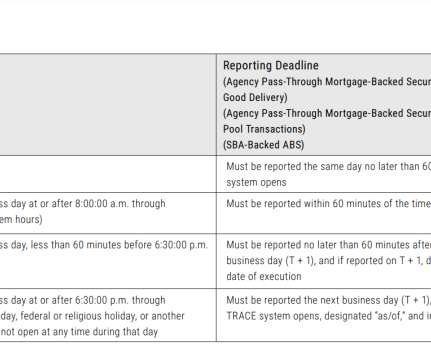

In my over thirty years of experience in the financial services industry, I have learned a thing or two about completing, reviewing, and filing various types of reports — some of which have extremely tight restrictions and constraints to which the reporter must abide. Treasury Securities to TRACE. Interested in learning more?

Let's personalize your content