6 Reasons Financial Institutions Are Embracing Risk and Regulation Tactics

Perficient

DECEMBER 18, 2023

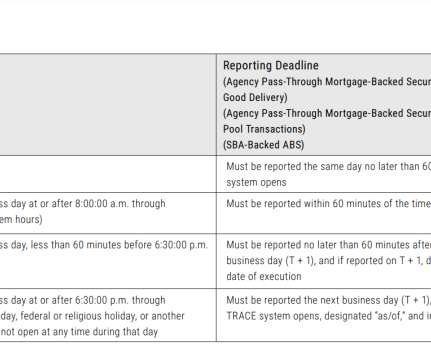

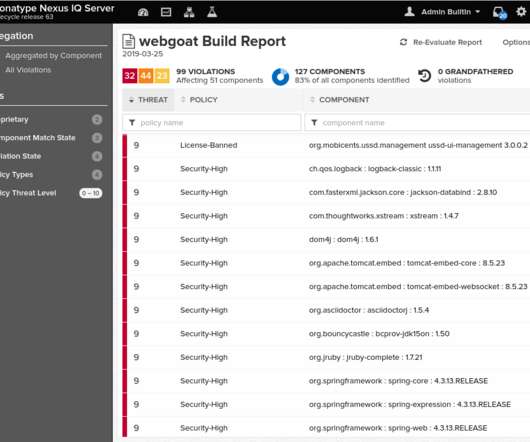

In the fast-paced realm of finance, the significance of regulatory risk and compliance management practices cannot be overstated. The Role of Regulatory Risk and Compliance 1. Legal Obligations and Regulatory Frameworks It is well-known that financial institutions operate within a complex web of laws and regulations.

Let's personalize your content