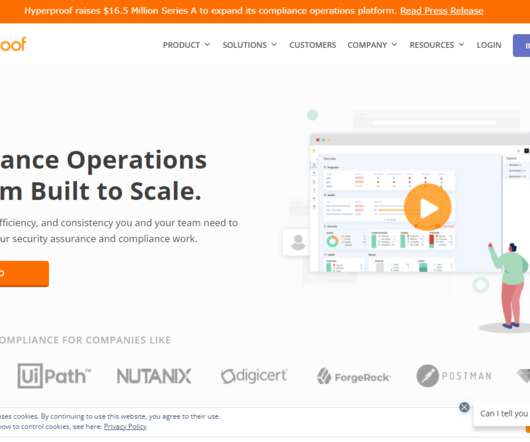

Hyperproof, An Enterprise Governance, Compliance, And Risk Management Technology Provider, Raises $16.5M In Series A Funding

CB Insights

OCTOBER 29, 2021

Hyperproof , an enterprise governance, compliance, and risk management technology provider, has raised $16.5M Seattle-based Hyperproof provides compliance solutions for continuous risk management across key industries, such as security tech, enterprise software, fintech, healthcare tech, and data communications.

Let's personalize your content