Derivatives Usage By Community Banks

South State Correspondent

JULY 19, 2023

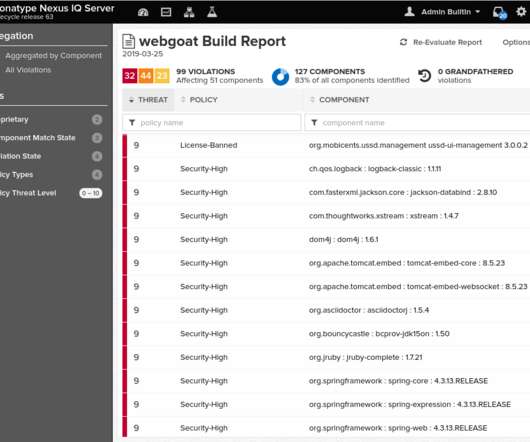

Our previous article discussed how the banking industry is taking advantage of interest rate swaps to offer borrowers lower rates, allowing banks to earn higher yields, generate substantial fee income, and protect deposit relationships. Regulatory compliance and reporting can be complex and confusing.

Let's personalize your content