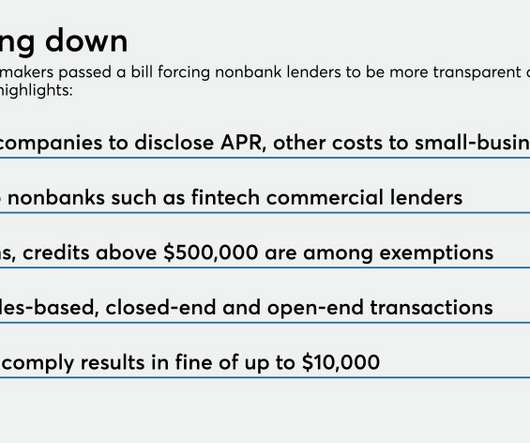

Prosecutors Target Loosely-Regulated Business Lending Sector

PYMNTS

AUGUST 11, 2020

Federal and state authorities are targeting companies that allegedly lend money to small businesses at extreme rates and seek to collect payments with heavy-handed tactics, NBC News reported Tuesday (Aug. Representatives of the companies either denied wrongdoing or declined to comment.

Let's personalize your content