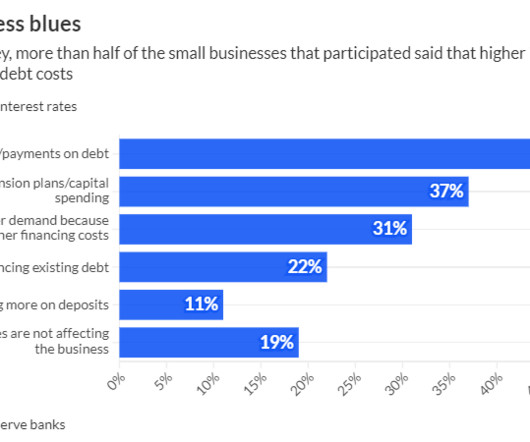

Small businesses feel the pain of higher interest rates

American Banker

MARCH 18, 2024

Some 54% of small businesses said in a recent survey that elevated rates had led to higher debt payments. And in a sign that loan demand remains soft, 37% reported delaying expansion plans or capital spending.

Let's personalize your content