Cash use persists in US beyond pandemic

Payments Dive

JUNE 11, 2024

Consumers remained committed to cash use last year, even as the share of card payments rose and online payments increased, according to an annual Federal Reserve study.

Payments Dive

JUNE 11, 2024

Consumers remained committed to cash use last year, even as the share of card payments rose and online payments increased, according to an annual Federal Reserve study.

BankInovation

JUNE 12, 2024

ING is running a generative AI-driven chatbot pilot in the Netherlands before it plans to scale the technology. The pilot funnels only 2.5% of clients’ chats into its gen-AI chatbot, Chief Analytics Officer Bahadir Yilmaz told Bank Automation News at the recent Money2020 Europe event in Amsterdam.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Gonzobanker

JUNE 6, 2024

Add these action items to your card fraud checklist to strengthen your defenses. The hacker group ShinyHunters allegedly breached Ticketmaster’s data in late May 2024, including credit and debit card information for over 560 million consumers worldwide. That’s more than 2.5 times the prior largest breach of Experian a decade ago. So, what will happen to U.S.

TheGuardian

JUNE 11, 2024

Institutions alleged to have given billions of dollars to oil and gas companies involved in projects that are harming the rainforests Five of the world’s biggest banks are “greenwashing” their role in the destruction of the Amazon, according to a report that indicates that their environmental and social guidelines fail to cover more than 70% of the rainforest.

Advertisement

Shifting liability for digital fraud losses represents a significant challenge for financial institutions and payment service providers. In response to the global surge in digital fraud, regulators are introducing policies that transfer the cost of fraud from defrauded customers to financial institutions. ThreatMark’s newly released white paper, "The Liability Shift: Understanding Fraud Losses Responsibility and Mitigation," provides an in-depth analysis of this shift, its implications, and stra

Jack Henry

JUNE 7, 2024

Explore top insights from Jack Henry's 2024 Strategy Benchmark. Dive into key findings on financial benchmarks such as technology trends, metrics, & more.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

ATM Marketplace

JUNE 11, 2024

How can banks successfully deliver customer transformation initiatives? A panel at the upcoming Bank Customer Experience Summit from Sept. 9 to 11 in Charlotte will offer the secret ingredients to a successful transformation.

TheGuardian

JUNE 10, 2024

Win would benefit banks, builders and supermarkets, say analysts, showing appeal of ‘centrist platform’ for City UK general election live – latest updates A Labour election victory will be a “net positive” for financial markets, strategists at the US bank JP Morgan have said, in an analysis that underlines the appeal of Keir Starmer’s “centrist platform” to the City of London.

American Banker

JUNE 7, 2024

U.S. regulators need to do more to require banks to recognize the risks posed by climate change, and the damage that continuing to support fossil fuel extraction projects does to the environment.

The Paypers

JUNE 10, 2024

Saudi Central Bank has joined Project mBridge, collaborating with China, Thailand, Hong Kong, and UAE to test central bank digital currencies for cross-border trade and payments.

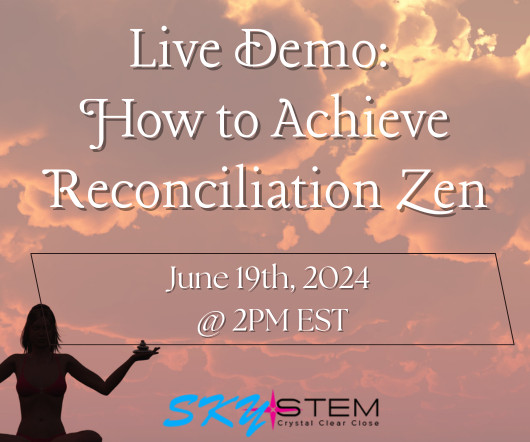

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Payments Dive

JUNE 10, 2024

The three companies announced last Wednesday that they are teaming up to launch a free service intended to combat fraud and reduce the amount of transactions that are improperly declined.

BankInovation

JUNE 12, 2024

Technology provider Temenos will integrate Mastercard’s Mastercard Move solution to provide banks with international money transfer capabilities. Mastercard Move will enable Temenos’ bank clients to use a range of options to cost-effectively route and deliver money, according to a June 4 Temenos release.

ATM Marketplace

JUNE 7, 2024

Want to upgrade your ATM fleet? Here are three easy steps you can take.

American Banker

JUNE 7, 2024

In the U.S., the COVID-19 pandemic and other factors caused a sharp reduction in cash use. But with paper bills still accounting for nearly a fifth of all payments, the option is still far too entrenched to risk extinction.

Advertisement

Dive into the complexities of New York lien laws with our comprehensive eBook, 'New York Lien Law Essentials: 5 Key Facts for Commercial Lenders.' In this detailed guide, we explore the critical formalities necessary for lenders navigating ground-up construction and fix-and-flip projects in the New York market. From documentation requirements to the implications of non-compliance, learn how to safeguard your lending position and prioritize legal adherence.

The Paypers

JUNE 12, 2024

NMI has announced a new Shopify integration that provides ISO partners with more choices for merchant payment offerings, along with better security and compliance.

Payments Dive

JUNE 12, 2024

The P2P ‘Tap to Cash’, which enables iPhone users to transfer money by holding their phones together, was unveiled along with a slate of other features Monday.

BankInovation

JUNE 10, 2024

ING and Deutsche Bank are looking to AI to boost efficiencies and provide personalized banking experiences for their clients. AI adoption is growing among financial institutions, according to Nvidia’s 2024 State of AI in Financial Services report.

ABA Community Banking

JUNE 12, 2024

CFPB should incorporate stakeholder feedback as it finalizes the rule to “reduce ambiguity” and to ensure “an effective rollout that limits disruptions to consumers," the groups said. The post ABA, trade groups ask CFPB to consider small firms’ needs as it finalizes Section 1033 rule appeared first on ABA Banking Journal.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

JUNE 10, 2024

An interchange provision included in Illinois' budget bill could force banks and payment processors nationwide to revamp their payments infrastructure, lobbying groups for the industry say.

The Paypers

JUNE 12, 2024

Ripple has partnered with the National Bank of Georgia to explore ways to digitise the country’s local economy.

Payments Dive

JUNE 6, 2024

State lawmakers are negotiating three separate proposals related to the buy now, pay later industry ahead of the end of the legislative session on Thursday.

BankInovation

JUNE 6, 2024

AMSTERDAM — Deutsche Bank is one of multiple financial institutions sharing anonymized data with financial messaging service provider Swift. The process will test the use of secure data-sharing for AI-driven fraud prevention, Joanne Hannaford, chief information officer and chief product officer of corporate bank at Deutsche Bank, said at Money2020 Europe on June 4.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Realwired Appraisal Management Blog

JUNE 6, 2024

There’s an opportunity for appraisers with developers and investors to be a canary in the CRE coal mine. The buyer’s due diligence journey could START with an appraisal rather than at the end. No guess work. No wasted time. No wasted money.

American Banker

JUNE 11, 2024

The $684 billion-asset institution adopted the family finance fintech's app and linked debit cards to provide account holders with tools for educating their children about the financial system.

The Paypers

JUNE 10, 2024

The US Treasury has asked the public to share their input regarding the use of artificial intelligence (AI) in the financial services sector.

Payments Dive

JUNE 12, 2024

“Since many of these deepfake software services accept credit cards, payments providers are on the front lines of detecting these companies,” writes one corporate compliance officer.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

Let's personalize your content