2020 CRE Outlook: Trends Expected to Shape Commercial Real Estate Lending

Abrigo

FEBRUARY 12, 2020

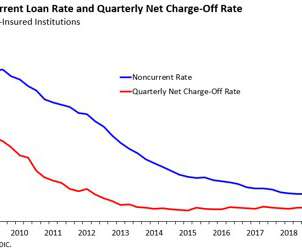

Key Takeaways Commercial real estate lending will be a top focus for many financial institutions in 2020. The Mortgage Bankers Association expects 9% growth in CRE originations in 2020. Despite expectations for growth, bankers, regulators, investors, and others are watchful about potentially lower returns and credit risks ahead.

Let's personalize your content