The math behind small business lending: Problems & possibilities for banks & credit unions

Abrigo

APRIL 22, 2024

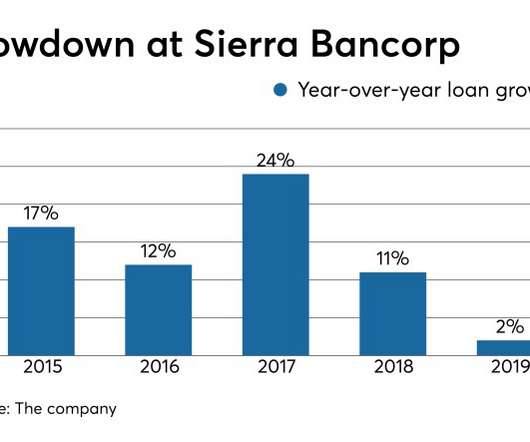

Recent dynamics of the small business lending market A deep understanding of the small business lending landscape and potential efficiencies can help banks and credit unions grow their portfolios. You might also like this guide for smarter, faster small business lending.

Let's personalize your content