Why You Should Review Your Home Loan Periodically

BankBazaar

FEBRUARY 11, 2020

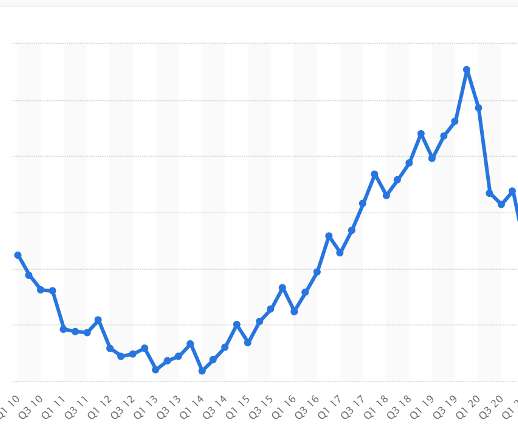

A Home Loan is a long-term commitment of at least 15-20 years. This is why it’s crucial that you review your Home Loan from time to time. . Taking a Home Loan is a big step. While this investment can help you save up to Rs. Interest rates on loans keep changing.

Let's personalize your content