4 Ways to evaluate your loan review department’s effectiveness

Abrigo

OCTOBER 10, 2023

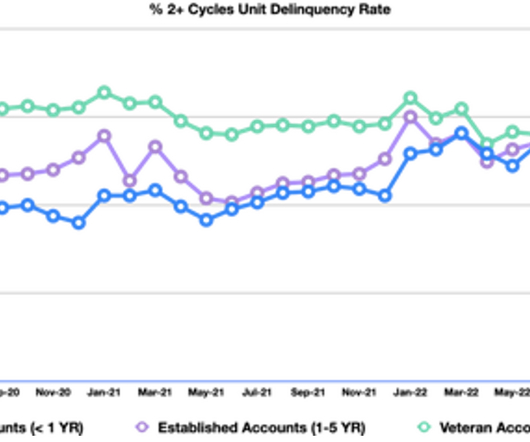

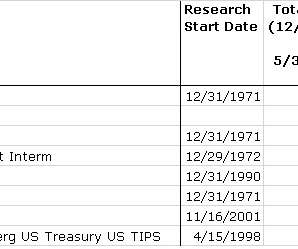

Loan review issues include staffing challenges and training. Last year's 2022 Loan Review Survey by Abrigo found these four common challenges in effective loan review. A key component of understanding and reacting to these concerns is the loan review function.

Let's personalize your content