What Quibi’s Flameout Teaches Us about Behavior Change

Perficient

OCTOBER 29, 2020

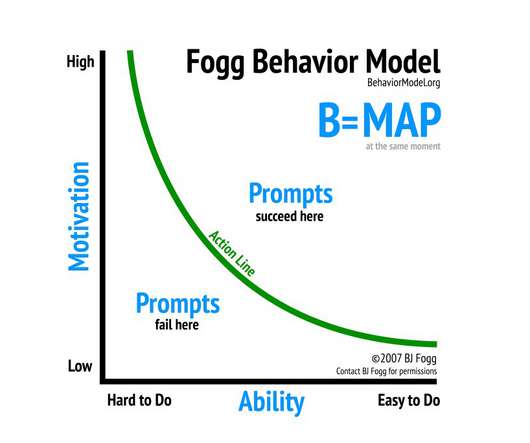

Last week mobile TV platform Quibi announced plans to shut down operations, just seven months after a promising debut. Making matters worse, early versions of Quibi offered no way for users to share content with friends, stymieing growth on social media. Quibi needed to move users above the FBM action line.

Let's personalize your content