Online Lending To Small Business Increases 50 Percent Between 2015 And 2017

PYMNTS

JUNE 1, 2018

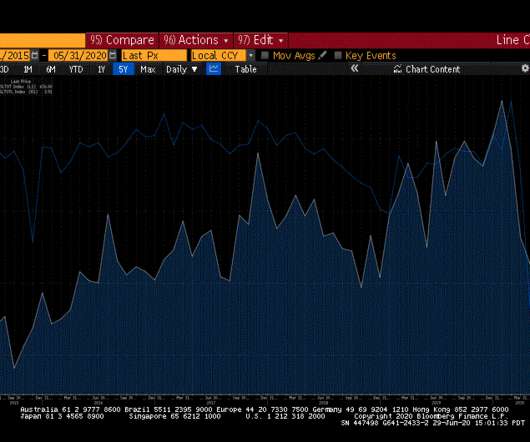

Between 2015 and 2017, the amount of lending to small businesses by the five leading online lending providers increased 50 percent, according to a new report from NDP Analytics, a Washington, D.C.-based The report, entitled “The Economic Benefits of Online Lending to Small Businesses and the U.S. billion in 2017 from $2.6

Let's personalize your content