Fintech Farm raises USD 32 mln for Indian operations expansion

The Paypers

MAY 13, 2024

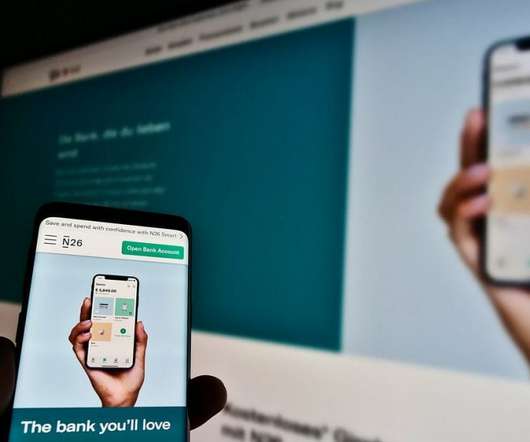

UK-based Fintech Farm , a startup that provides technology to medium-sized banks in developing markets to build digital tools, has raised USD 32 million in Series B funding.

Let's personalize your content